Introducing

Mortgages Made Simple

Dreams Made Possible

We compare offers from more than 30 banks and lenders, resulting in an average savings of over $10,000* for borrowers.

Customers must qualify. Terms apply

PRE-APPROVAL, APPROVAL, REFINANCE OR SWITCH

We handle negotiations with these lenders, saving you the need to do so.

Crafting Mortgages for

Your Unique Story.

We compare offers from more than 30 banks and lenders, resulting in an average savings of over $10,000* for borrowers.

Digital HELOC

Apply online. Fast approval. No commissions.

- Unlock a $50k - $ 500k line of credit

- Access up to 90% of the property value

- Available for primary, second, and investment homes

Refinance

Low rates. Save thousands. Close fast.

- Apply 100% online, on your schedule.

- No commissions

- Close 17 days faster than industry avg.

Buy & Sell

Partner with a local expert and save big.

- $2k off Better Mortgage closing costs3

- Local expert knowledge

- Seamless communication with Better Mortgage

3 EASY STEPS

The way we help Canadians save thousands on their mortgage.

STEP 1

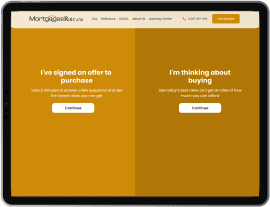

Complete your online application in just 5 minutes

By asking a few straightforward questions, we create a personalized profile to connect you with the most suitable choices available. This not only saves you time but also helps you save money. Say goodbye to aggressive salespeople.

STEP 2

We secure the finest mortgage solution for you

Our goal is to find you the most competitive rates and advantageous terms available. With a selection of over 30 lenders, we customize your mortgage to potentially save you a substantial amount. Setting us apart from competitors, we offer clear and open choices throughout the process.

STEP 3

Obtain endorsement with human assistance

Throughout the approval to the closing process, we strive to reduce your costs. While our AI technology explores the market, you'll have a dedicated Swift Borrow Advisor to assist you at every stage. They offer clear guidance in the manner and timing that suits you best.

Making my dream of owning a home a reality.

Crafting Mortgages for Your Unique Story.

We compare offers from more than 30 banks and lenders, resulting in an average savings of over $10,000* for borrowers.

WHY PICK Swift Borrow

Over The Other Guys?

"Swift Borrow Mortgage Services simplified the entire process for me. With their personalized recommendations and responsive support, I felt confident in choosing the best mortgage for my needs."

"Working with Swift Borrow Mortgage Services was a game-changer. Their expert team walked me through every step, offering unmatched support and competitive rates tailored to my needs."

"Choosing the right mortgage company was challenging until I came across Swift Borrow Mortgage Services. Their quick approvals, transparent process, and competitive rates made the entire experience stress-free."

Borrowers like you

What Our Customers Say

Discover why Canadians have used our simple online application for mortgages totaling over.

Commonly asked questions

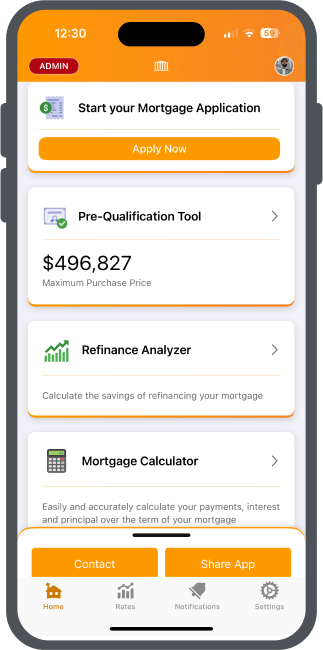

Qualification depends on factors like credit score, income, debt-to-income ratio, and down payment. Our website offers a pre-qualification tool to give you an idea of your eligibility.

- Purchase

- Refinance

- Renewal

- Private mortgage

- Reverse mortagge

- Pre approvals

- commercial mortgages

You can apply online through our secure portal or schedule an appointment with us.

The process usually takes 24-48 hours from application to closing, but this can vary based on individual circumstances.

Rates are influenced by market conditions, your credit score, loan term, and down payment amount.

Your payment typically includes principal, interest, property taxes, and homeowners insurance (often referred to as PITI).

Yes, Most mortgages come with the option of prepayment of options of 20% of mortgage can be payoff without penalty.

Check your specific loan terms for details

Yes , we offer in – person consultations at our office located in Lethbridge, alberta.

We also provide virtual meeting through facetime, messenger and google meet. You can schedule an appointment by contacting us

"Finding the perfect mortgage company seemed overwhelming until I found Swift Borrow Mortgage Services. Their expert team guided me step by step, offering tailored options that fit my needs perfectly."